Overview

A municipality, also called a city, is a local unit of government in Texas. Municipalities provide public services like police, fire, and utilities, and they levy taxes to pay for these services. The largest municipalities in Texas have more than a million residents, while medium-sized cities typically have about 50,000 to 250,000 residents.

Municipalities govern small urban communities too. Texas does not have township or village forms of government, so even very small towns are legally called “cities” or municipalities. The minimum population for incorporation as a city is 201 residents.

However, large and small municipalities in Texas vary in their legal structure and the services that they offer, as state law defines several different types of municipalities. While all municipalities in Texas have certain baseline powers, larger municipalities often have more complex governance structures and may exercise additional powers.

For example, larger cities generally have specialized departments for public health, arts and culture, libraries, and economic development, while smaller municipalities focus more on core services like street repair, fire and police, water, and wastewater.

Many cities in Texas have grown substantially in recent decades, fueling the growth of municipal bureaucracies and budgets. Despite its past legacy as a largely rural state, known for its Cowboy and ‘Wild West’ heritage, Texas today is highly urban and suburban. Texas is home to four of the ten largest cities in the United States.

| Rank | Largest Cities in Texas | Population |

|---|---|---|

| 1 | Houston | 2,314,157 |

| 2 | San Antonio | 1,495,295 |

| 3 | Dallas | 1,302,868 |

| 4 | Austin | 979,882 |

| 5 | Fort Worth | 978,468 |

| 6 | El Paso | 678,958 |

| 7 | Arlington | 398,431 |

| 8 | Corpus Christi | 316,595 |

| 9 | Plano | 290,190 |

| 10 | Lubbock | 266,878 |

Elected and Appointed City Officials

In Texas, city officials are typically elected by the residents of the municipality, although some positions may also be appointed depending on the city’s form of government. The process of electing city officials varies by the size and type of municipality, but it generally includes elections for key positions such as the mayor, city council members, and in some cases, other specific roles like city controllers or auditors.

Elections for municipal officeholders are usually held on a regular basis, often every two or four years, depending on the city’s charter. The method of electing the mayor and council members varies, with some cities holding at-large elections, where all residents can vote for all council seats, and others using district-based elections, where council members are elected from specific areas within the city.

In addition to elected positions, some municipalities appoint key officials such as the city manager, city attorney, or city clerk. These appointments are typically made by the city council, which holds the responsibility for overseeing the day-to-day operations of the city. Appointed officials serve at the pleasure of the council and are tasked with implementing policies, managing departments, and ensuring the smooth running of city services.

General Powers of Municipalities

Municipalities in Texas generally have the authority to exercise the following powers:

- Levy taxes: Impose property and sales taxes to fund municipal services.

- Provide essential services: Offer services such as police, fire, sanitation, and utilities.

- Enter contracts: Form agreements with other governments or private entities for public services and development.

- Adopt and enforce ordinances: Create local laws to regulate issues not covered by state or federal law, such as parking and noise regulations.

- Manage public infrastructure: Oversee roads, bridges, parks, and public libraries.

- Zoning and land use: Regulate the development and use of property within city limits.

- Eminent domain: Seize private property for public use, with compensation to the owner.

Additionally, some municipalities, particularly “home-rule” cities, have additional powers granted by their charters. These cities may have broader authority to enact policies on issues such as annexation, economic development, and the regulation of city-run enterprises.

However, municipal governments in Texas play no role in public education, which is run by independent school districts, charter schools, and other entities.

Types of Municipalities in Texas

In Texas law, there are three types of municipality: general-law, home-rule, and special-law. General-law municipalities operate under powers given to them by the state, while home-rule municipalities also operate under a city charter.

- Home-rule municipality: operates under a municipal charter adopted by Article XI, Section 5, of the Texas Constitution. A city must have more than 5,000 inhabitants in order to qualify for home-rule status. The city may adopt a charter by majority vote.

- General-law municipality: operates under state law. Must have between 201 and 9,999 inhabitants at time of application for incorporation.

- Special-law municipality: operates under a municipal charter granted by a local law enacted by the Congress of the Republic of Texas or by the Legislature.

Legally, there are no “townships” or “villages” in Texas, as there are in some other states, though some municipalities do refer to themselves by those terms.

‘Strong Mayor’ vs City Manager Systems

Another key distinction is between the mayor-council form of municipal government and the council-manager form. Municipalities of both types are found in Texas.

In the former, the mayor is the chief executive and chief administrator of city government and exercises substantial executive powers in the day-to-day affairs of the city. This is also sometimes called a “strong mayor” form of government.

But in cities with the council-manager form of government, the mayor has little more authority than a council member. The mayor presides over council meetings and fulfills ceremonial duties, but day-to-day management of the city falls to a hired city manager, who is accountable to the whole council, not just the mayor.

Austin, Dallas, San Antonio, El Paso, Fort Worth, Arlington, Corpus Christi, Plano, and Laredo all have a council-manager (“weak mayor”) form of government; Houston has a mayor-council (“strong mayor”) form of government.

Via charter adoption or amendments, home-rule cities are free to choose which type of system they want to have, whether a ‘strong mayor’ system or a council-manager (‘weak mayor’) form.

Municipal Ordinances

Municipalities have the power to adopt ordinances governing certain matters. Ordinances are the equivalent of a local law and deal with matters not already covered by federal or state law. Municipal ordinances often regulate activities that directly impact daily life, such as noise levels, pet ownership, and traffic rules, ensuring a smooth-running urban environment.

Violations of municipal ordinances are punishable by fines of up to $500, except in cases of public health, zoning, and fire safety violations, in which case the fine may be up to $2,000.

Municipal Zoning Regulations

Zoning is the practice of dividing a city into districts with prescribed building regulations for each district. Usually, a city that implements zoning is divided into residential, commercial, industrial, and agricultural districts. Zoning may regulate the height of buildings, percentages of a lot that may be occupied, the size of yards and open spaces, and other matters.

Texas cities’ zoning regulations must comply with chapter 211 of the Local Government Code, the state law that deals principally with municipal zoning.

Municipal Taxes

Municipalities are entitled to collect both property tax and sales tax.

Maximum sales tax rate: The maximum sales tax rate for a Texas city is 2%. However, local governments collectively are entitled to a 2% maximum sales tax rate, which means that a city may not be able to collect the full 2% if other taxing entities already have set a sales tax rate.

Maximum property tax rate: The maximum property tax (ad valorem) rate of a Texas city depends on the size of the city:

- Texas cities with a population of 5,000 or less can levy a maximum tax rate of $1.50 per $100 of assessed valuation.

- Texas cities with a population of more than 5,000 can levy up to $2.50 per $100 of assessed valuation.

- Type B general law cities can levy a maximum of $0.25 per $100 of assessed valuation.

These limits are set by the constitution and state law. City charters may further restrict the maximum rate.

Intergovernmental Relations

Municipal governments in Texas do not operate in isolation; they frequently cooperate with county, state, and federal authorities to address shared challenges and implement policies. Cities often enter into interlocal agreements with counties, school districts, and other local entities to share services such as emergency response, public health initiatives, and transportation infrastructure.

Additionally, Texas municipalities collaborate with state agencies such as the Texas Commission on Environmental Quality (TCEQ) and the Texas Department of Transportation (TxDOT) to regulate environmental policies and maintain roadways. Federal grants and funding programs also play a role in municipal governance, particularly in areas such as disaster relief, public housing, and infrastructure development. These partnerships help local governments maximize their resources and address broader regional concerns.

Annexation and City Growth

Texas municipalities have the authority to expand their boundaries through annexation, a process that allows cities to incorporate adjacent land into their jurisdiction. Annexation enables municipalities to manage growth, extend public services, and regulate development in expanding urban areas.

Historically, Texas had broad annexation laws that permitted cities to annex land without the consent of property owners. However, the Texas Legislature passed reforms in recent years that now require voter approval in certain annexation cases. These new laws have significantly impacted the way cities approach expansion, making voluntary annexation agreements more common. Municipalities must carefully balance growth with the financial and logistical challenges of providing services to newly annexed areas.Safety and Law Enforcement

Municipal Budgeting and Finance

The financial health of a municipality depends on effective budgeting and fiscal management. City governments in Texas operate on annual or biennial budget cycles, planning expenditures for essential services, infrastructure projects, and public programs.

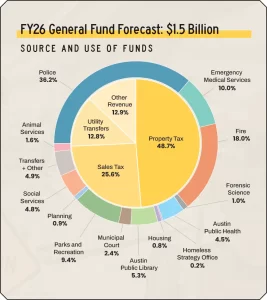

A city’s budget is typically divided into two main categories: the general fund, which covers basic operations such as police, fire, and sanitation, and special funds, which may include grants, enterprise funds (e.g., water utilities), and capital improvement projects. Revenue sources include property taxes, sales taxes, fees, fines, and intergovernmental transfers.

Municipalities must comply with the Texas Constitution and state laws that impose debt limitations and require transparency in budget adoption. Cities often engage in public hearings and community input sessions to determine spending priorities and ensure fiscal responsibility.

Creation of New Municipalities

In order to form a general-law municipality, the residents of a community may file an incorporation application with the county judge, signed by at least 50 qualified voters who are residents of the community.

A judge who receives such a petition must order an incorporation election to be held on a specified date and at a designated place in the community. The voters then get to decide whether to incorporate the area as a municipality or not.