The appropriations process refers to the manner in which the Texas Legislature authorizes the expenditure of government funds, setting money aside for specific expenses.

In Texas, the Legislature usually passes a single General Appropriations Act every two years. That’s because government finances in Texas operate on a two-year cycle known as a biennium. However, the Texas Legislature may deviate from the two-year appropriations cycle with other types of spending bills, such as emergency, supplemental and deficiency appropriations.

Before 1951, the Legislature passed multiple spending bills each two-year legislative cycle, rather than a single General Appropriations Act.

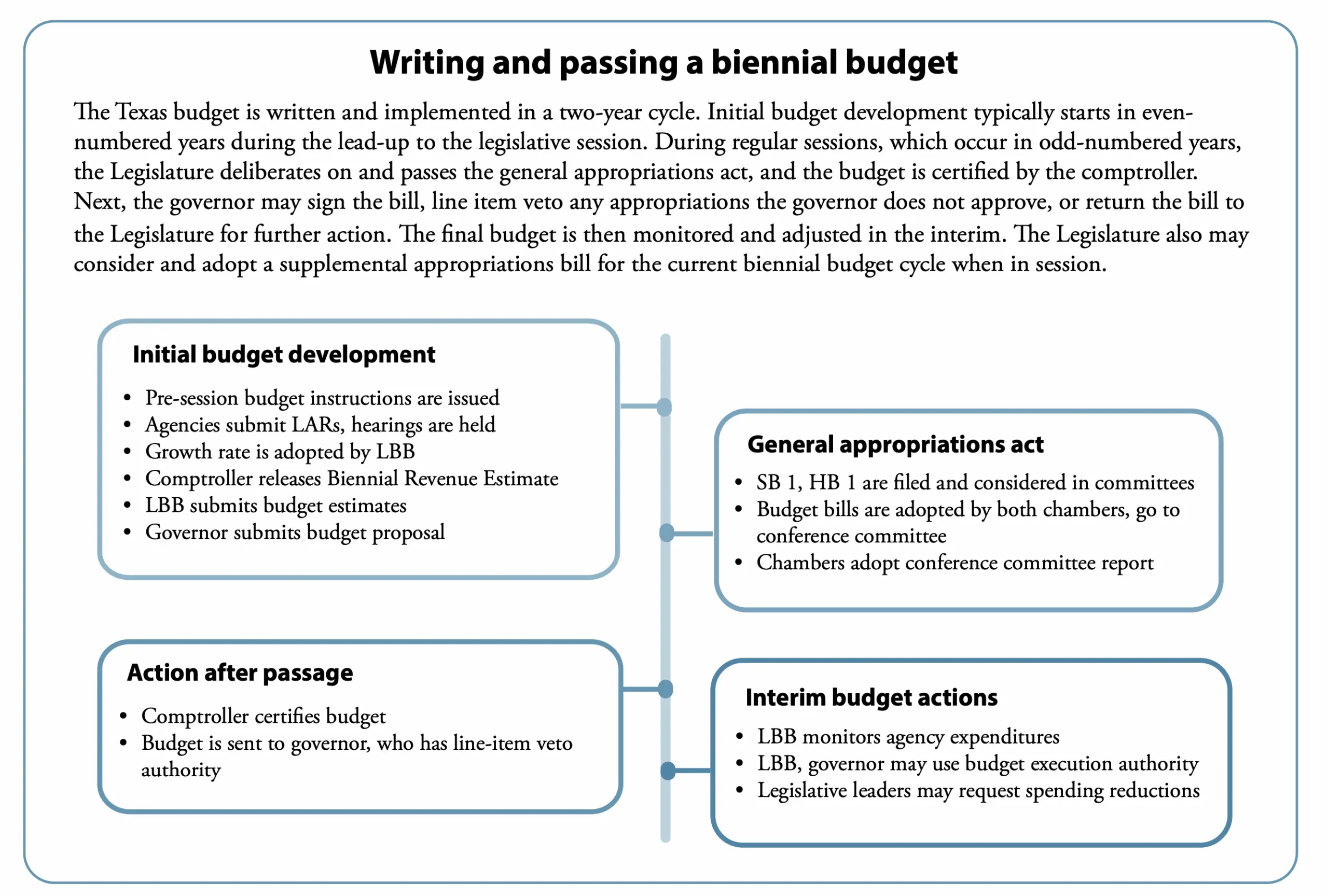

Stages of the Budget Process

The appropriations process in Texas follows a structured series of steps to ensure transparency, efficiency, and alignment with state priorities. Below are the key steps involved in the appropriations process in Texas.

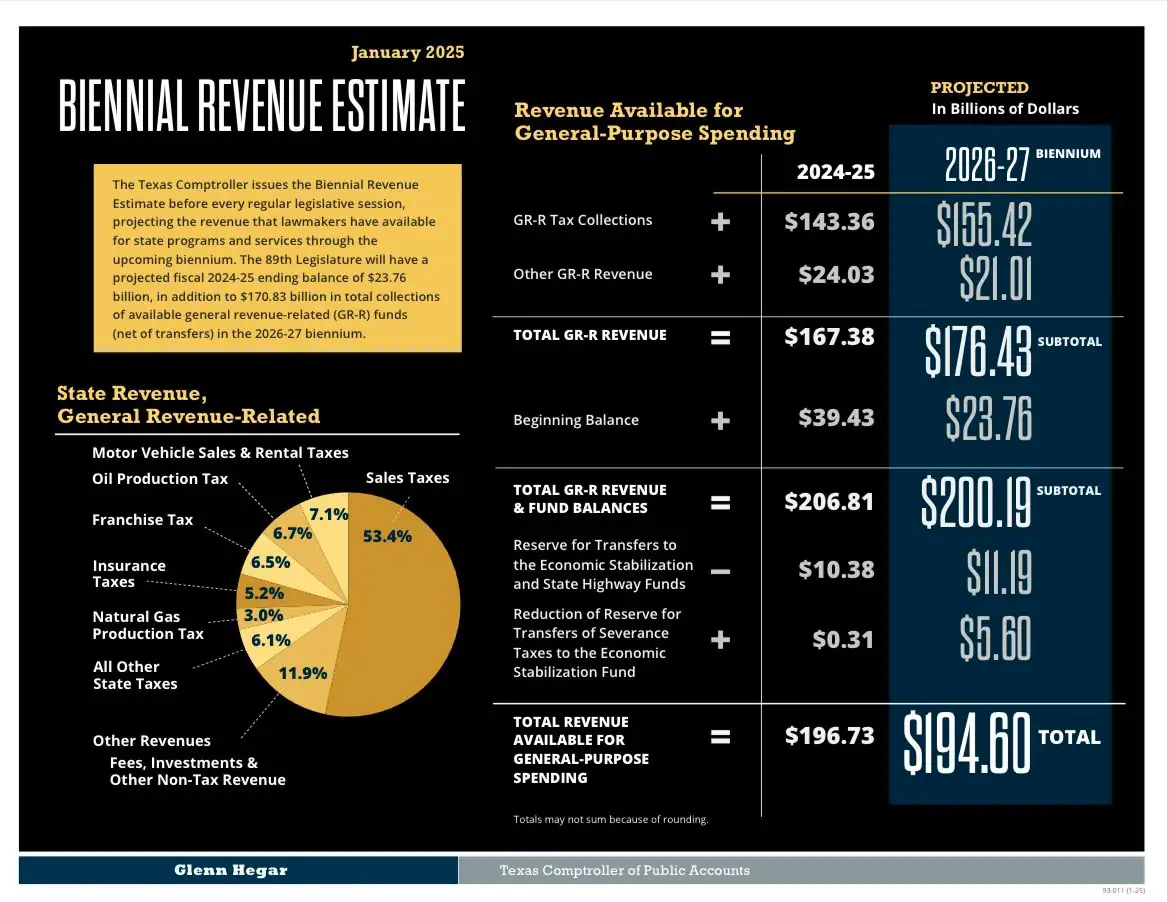

- Revenue Estimates and Budget Development – The process begins with the Comptroller of Public Accounts providing a Biennial Revenue Estimate (BRE) to project the state’s available funds. This estimate helps guide budget decisions by setting the financial parameters for appropriations.

- Legislative Appropriations Requests (LARs) – State agencies and institutions submit Legislative Appropriations Requests (LARs) to the Legislative Budget Board (LBB) and the Governor’s Office of Budget, Planning, and Policy. These requests outline the funding needs and priorities for the upcoming biennium.

- Legislative Budget Board Review – The Legislative Budget Board, an agency headed by a committee of legislators, analyzes agency requests and prepares a draft budget. This preliminary budget serves as a foundation for legislative deliberations.

- Introduction of the General Appropriations Bill – The proposed budget is introduced in both the Texas House of Representatives and Texas Senate. The House version typically originates from the House Appropriations Committee, while the Senate works on its version through the Senate Finance Committee.

- Bill Styling: Since the late 1980s the General Appropriations Act in Texas almost always has gone by the bill number Senate Bill 1 (SB 1) or House Bill 1 (HB 1), alternating between a Senate designation and a House designation every session.

- Committee Hearings and Markups – Each chamber holds hearings where state agencies testify about their budget needs. Lawmakers review, amend, and debate the budget before sending it to the full chamber for a vote.

- House and Senate Approval – Both chambers must approve their respective versions of the appropriations bill. Differences between the two versions are reconciled through a conference committee made up of members from both chambers.

- Conference Committee Negotiations – The conference committee resolves discrepancies and produces a final unified budget bill. This compromise bill must then be approved by both the House and Senate.

- Governor’s Review and Action – The finalized appropriations bill is sent to the Governor of Texas, who can sign it into law, veto specific line items, or reject the entire bill. If line-item vetoes occur, the Legislature may override them with a two-thirds majority vote.

- Implementation and Oversight – Once enacted, state agencies receive funding and begin implementing their programs. The LBB and other oversight bodies monitor expenditures to ensure compliance with the approved budget.

Infographic: Texas Budget Cycle

Constitutional Spending Limits

The Texas Constitution limits the amount of money appropriated by the legislature in its biennial appropriations act. The appropriation may not exceed the cash and anticipated revenue that the Comptroller expects the state to have in the coming biennium.1

In other words, the legislature cannot spend more money than it receives. This is a key difference between the state government and the federal government, which can spend in excess of its revenue by borrowing money through the issuance of Treasury bonds.

The restriction on spending limits can be overridden by the Texas Legislature “in the case of emergency and imperative public necessity and with a four-fifths vote of the total membership of each House,” according to the state constitution.2

Moreover, a section of state law also limits the budget growth from one biennium to the next, linking it to the economic growth of the state: “The rate of growth of appropriations in a biennium from state tax revenues not dedicated by the constitution may not exceed the estimated rate of growth of the state’s economy.”3

The state constitution also prohibits appropriations for a period longer than two years: “No money shall be drawn from the Treasury but in pursuance of specific appropriations made by law; nor shall any appropriation of money be made for a longer term than two years.”4

Line Item Veto

Under the Texas Constitution, an appropriations bill passed by the legislature may be vetoed by the governor. The Texas governor may also block a single item of a spending bill, which is called a line-item veto.5 A governor’s line item veto may be overridden by a two-thirds vote of each chamber of the legislature, if it is in session.

This differs from the federal system, which does not give the U.S. president a line item veto. Although the president can veto an entire spending bill, he cannot veto specific parts or line items of a spending bill (or any bill, for that matter).

Latest Appropriations Act

The latest Appropriations Act in Texas, covering the two-year period of FY 2024 and FY 2025, was for $321.3 billion. The budget document was 1,115 pages long.

https://www.lbb.texas.gov/Documents/GAA/General_Appropriations_Act_2024_2025.pdf