The State of Texas imposes more than 30 different taxes, most of which are consumption taxes on the sale of goods or services. These taxes are collected by the Comptroller of Public Accounts, or other agencies of the state.

Texas uses tax revenues to fund about 40% of its state budget. In fiscal year 2020, another roughly 40% of the budget came from federal income, and the remaining 20% came from licenses and fees, lottery proceeds, legal settlements, and other sources.

There is no state or local income tax in Texas, and the state constitution prohibits the imposition of an income tax. Nor is there any state-level property tax, but indirectly the state collects some local property tax through the local governments, on behalf of the statewide school finance system.

Local property tax rates in Texas are higher than they are in many other states. Rates vary throughout the state and are set by political subdivisions, such as school districts, cities, and counties. Additionally, some local governments charge a local sales tax of up to 2%, on top of the state sales tax.

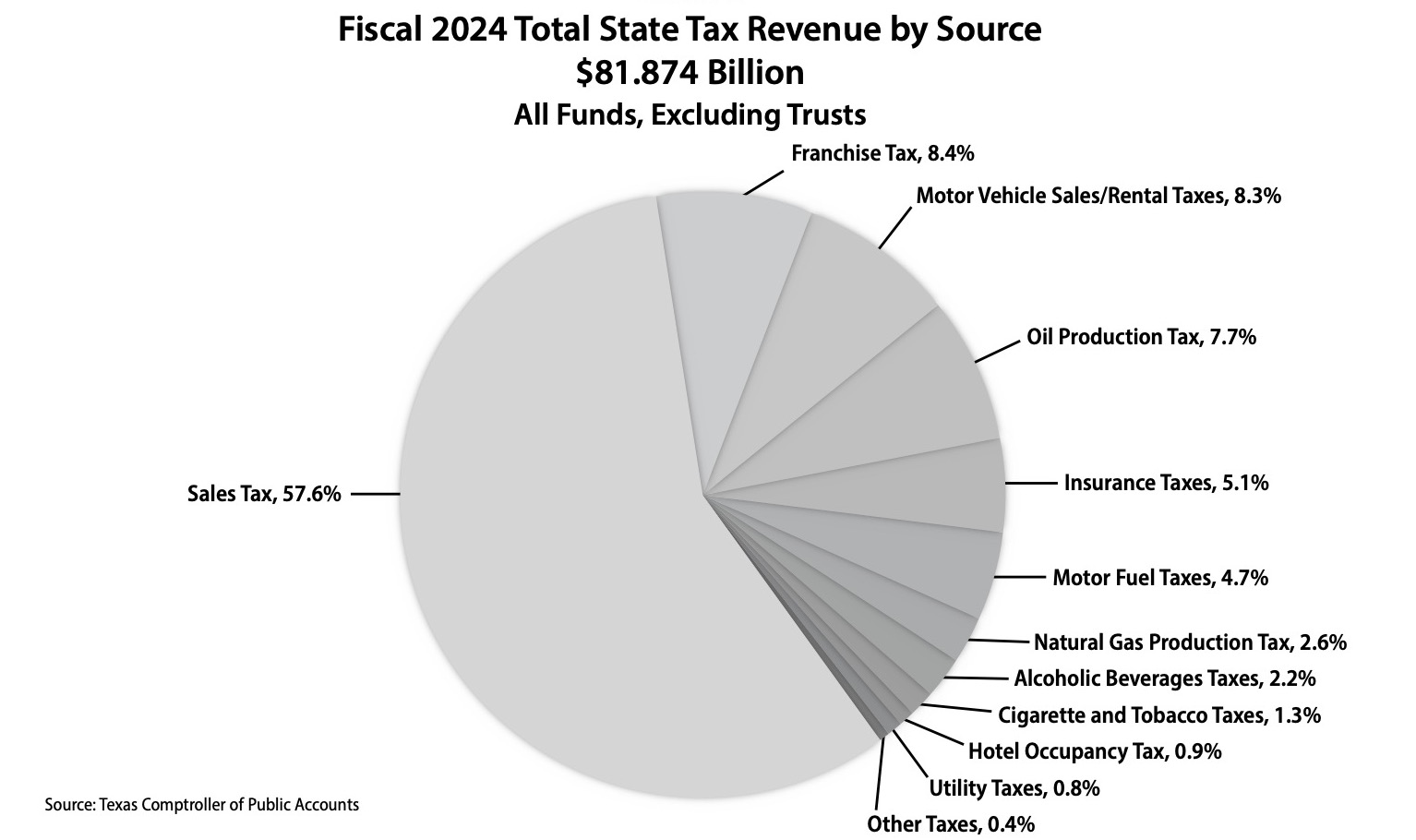

At the state level, the government collects the following taxes:

Sales and use tax. Texas imposes a 6.25% tax on sales, leases, and rentals of goods, as well as on taxable services such as telecommunications and amusement services.

Motor vehicle tax. Texas taxes motor vehicle sales at a rate of 6.25% of the sales price minus any trade-in allowance. Rentals are taxed at 6.25% or 10% of gross receipts depending on the length of the rental contract.

Motor fuel tax. Fuel tax rates in Texas vary depending on the type of fuel; the two most common, gasoline and diesel, both are taxed at 20 cents per gallon.

Franchise tax. Texas charges a variable rate on the taxable margin of corporations, banks, limited liability companies, and partnerships operating in the state. A rate of 0.375% applies to taxpayers in the resale or wholesale trade; others pay 0.75%. Firms with less than $20 million in total revenues may pay a lower rate of 0.331%.

Severance taxes. Severance taxes are taxes on the production of oil, condensate, and natural gas. Texas charges a 4.6% rate on the market value of oil produced, or 4.6 cents on each barrel, whichever is greater. It charges a 7.5% tax on the market value for natural gas.

Insurance taxes. Texas charges 0.875% tax for the first $450,000 of life insurance and HMOs and 1.75% in excess of $450,000. It charges 1.6% on property and casualty insurance, 1.75% on accident and health insurance, and 1.35% on title insurance.

Cigarette and tobacco taxes. Texas charges $70.50 per 1,000 cigarettes weighing 3 pounds or less ($1.41 per pack of 20), or $1.41 per pack of 20. Tax rates vary for cigars.

Alcoholic beverage taxes. Texas rates vary based on the beverage, alcohol content, and type of sale.

Hotel occupancy tax. Hotel occupancy tax rates in Texas vary widely by location. The minimum state rate is 6% of the room rate per day. On top of that, local governments may charge their own rate, up to a maximum of 17%. Hotel rooms that cost less than $15 are not taxable. The state’s 6% hotel tax is also levied on meeting rooms and banquet rooms in hotels.

Other taxes. Texas also charges a variety of utility taxes on public utilities, a cement tax, oil and gas well servicing tax, and combative sports admission tax, among others.

Local Tax Rates

Property tax rates vary throughout the state, with overlapping jurisdictions imposing different rates. County tax-assessor collectors collect property taxes on behalf of these entities. The state comptroller’s office maintains a database of the property tax rate imposed by each taxing unit in this state. It maintains a separate database of local sales tax rates throughout the state, which are added to the state rate of 6.25%.