Overview

The Economic Stabilization Fund, also called the ‘rainy day fund,’ was created to stabilize the Texas state budget in years when economic downturns affect tax revenue. The fund is replenished through a share of the state’s taxes on oil and gas production. It is managed by the Comptroller’s Office.

State law requires the legislature to establish a minimum balance for the Fund each biennium. For example, this “sufficient balance” was $7.5 billion for 2020-2021. This requirement was created in 2014 in response to fears that a small fund could hurt the state’s credit rating.

Allowable Uses of Rainy Day Fund

The Texas Constitution limits how funding from the rainy day fund may be used. During a regular legislative session, the legislature may appropriate money out of the rainy day fund “only for a purpose for which an appropriation from general revenue was made in a preceding legislative session of the same legislature.”

In other words, it can be used to pay for already planned governmental expenses. The emergency appropriation must be approved by a three-fifths vote, and it may not exceed the budget deficit.

With a two-thirds vote of each chamber, legislators can override this restriction and dedicate funds from the Economic Stabilization Fund “at any time and for any purpose.”

Current Fund Balance

As of 2025, the Texas Rainy Day Fund had a balance of about $25 billion.

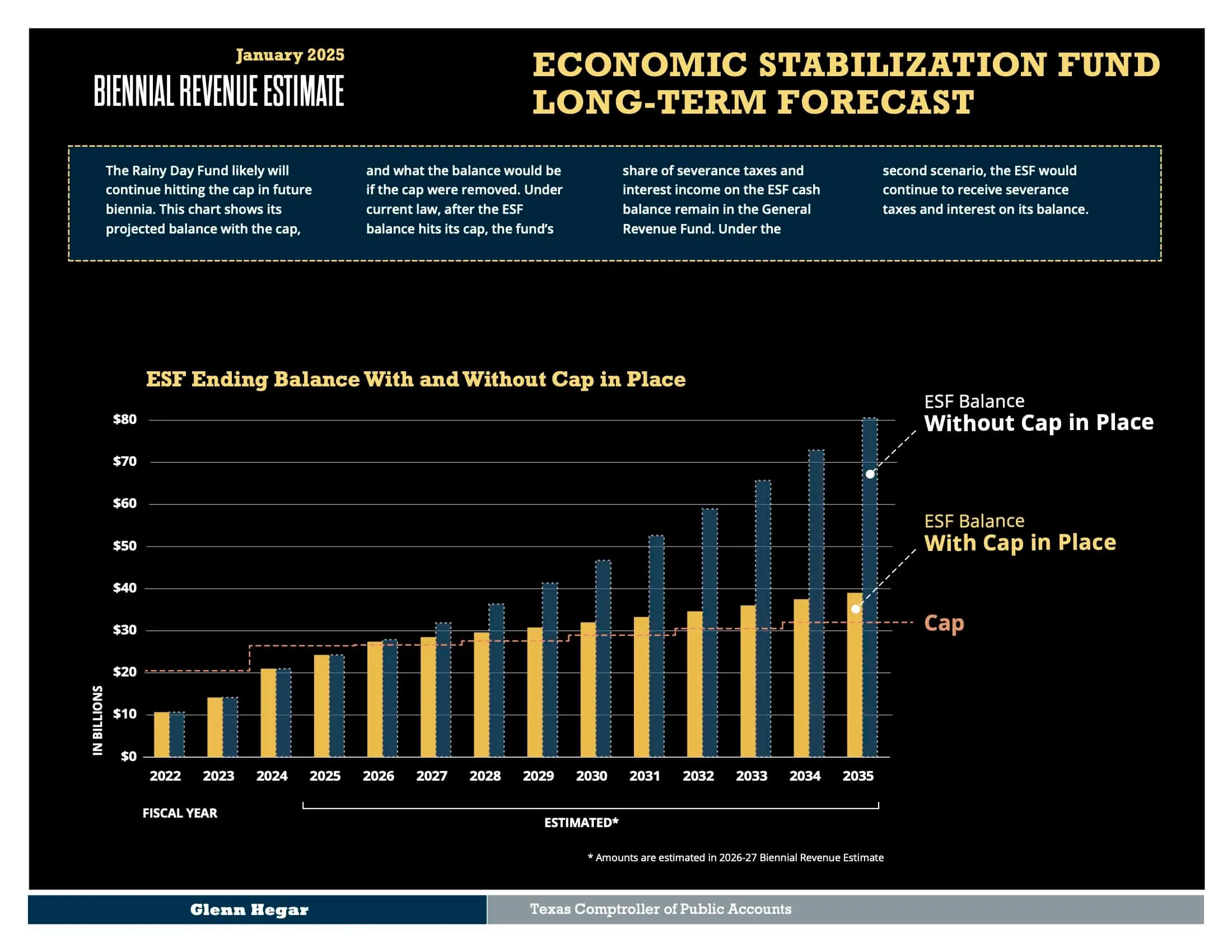

Long-Term Projection

The Comptroller of Public Accounts has projected that the Texas Rainy Day Fund could grow to a balance of nearly $40 billion by 2035.

Cap on Size of Fund

The Constitution limits how big the Economic Stabilization Fund can become. The cap is 10 percent of revenues deposited in General Revenue in the prior 2-year period, excluding interest and investment income and fund transfers, but including some federal revenue.

Fund Investments

Throughout most of its history, the Texas Treasury Safekeeping Trust Company, a special-purpose entity chaired by the comptroller, has invested rainy day fund revenue in short-term, low-yield, highly liquid instruments, to keep the funds readily available if needed.

In the 2015 Legislature authorized the Trust Company to invest a portion of the ESF balance through its Texas Economic Stabilization Investment Fund, in order to achieve a higher return that would beat inflation expectations.