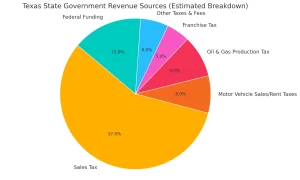

Texas is one of only a handful of U.S. states that do not levy a personal income tax, relying instead on other sources of revenue. While Texas does not tax personal income, residents are still required to pay federal income tax.

The state government funds its operations through a combination of consumption-based taxes, including the sales tax, motor vehicle taxes, and levies on oil and natural gas production. Local governments—such as cities, counties, and school districts—rely heavily on property taxes to fund public services.

Texas has never implemented a state personal income tax, though the idea has occasionally been discussed. In the early 1990s, Governor Ann Richards appointed a commission to study the state’s tax structure, which included consideration of an income tax as a way to reduce reliance on property and sales taxes. However, the proposal gained little political traction.

In 1993, the Texas Legislature passed a law requiring voter approval before any income tax could be imposed. That law served as a safeguard for over two decades, until voters adopted a more stringent constitutional prohibition in 2019.

Constitutional Ban on Income Tax

The Texas Constitution now explicitly prohibits the state from adopting a personal income tax. This ban is found in Article 8, Section 24-a, which states:

“The legislature may not impose a tax on the net incomes of individuals, including an individual’s share of partnership and unincorporated association income.”

This language was added via Proposition 4, a constitutional amendment approved by voters in November 2019. The amendment received unanimous support from Republican legislators and was backed by 45% of Democratic lawmakers. On election day, it passed with 1,477,373 votes for (74.4%) and 509,547 votes against (25.6%).

Supporters of the measure included Republican state officials, the Texas Republican Party, and fiscally conservative advocacy groups. Opponents included the Texas State Teachers Association, editorial boards from major Texas newspapers, Progress Texas, and the progressive policy organization Every Texan.

What Counts as “Income Tax”?

The constitutional language refers specifically to net income, meaning income after deductions and expenses. This is the traditional basis for personal income taxes. The amendment aimed to close any loophole by also prohibiting taxes on income from partnerships and similar business arrangements.

It’s worth noting that businesses in Texas may still be taxed through the franchise tax, sometimes referred to as a “margins tax.” This is not considered a personal income tax and is based on a business’s gross revenue with specific allowable deductions. It applies to many types of business entities, including corporations and LLCs.

Can This Ever Be Changed?

As a result of Proposition 4, it is now impossible for the Texas Legislature to enact a personal income tax without first repealing the constitutional prohibition. Doing so would require:

- A two-thirds vote in both the Texas House and Senate

- Approval by a majority of voters in a statewide constitutional amendment election

Given the political difficulty of reaching this threshold, and the broad public opposition to income taxes in Texas, it is highly unlikely that any form of personal income tax will be adopted in the foreseeable future.