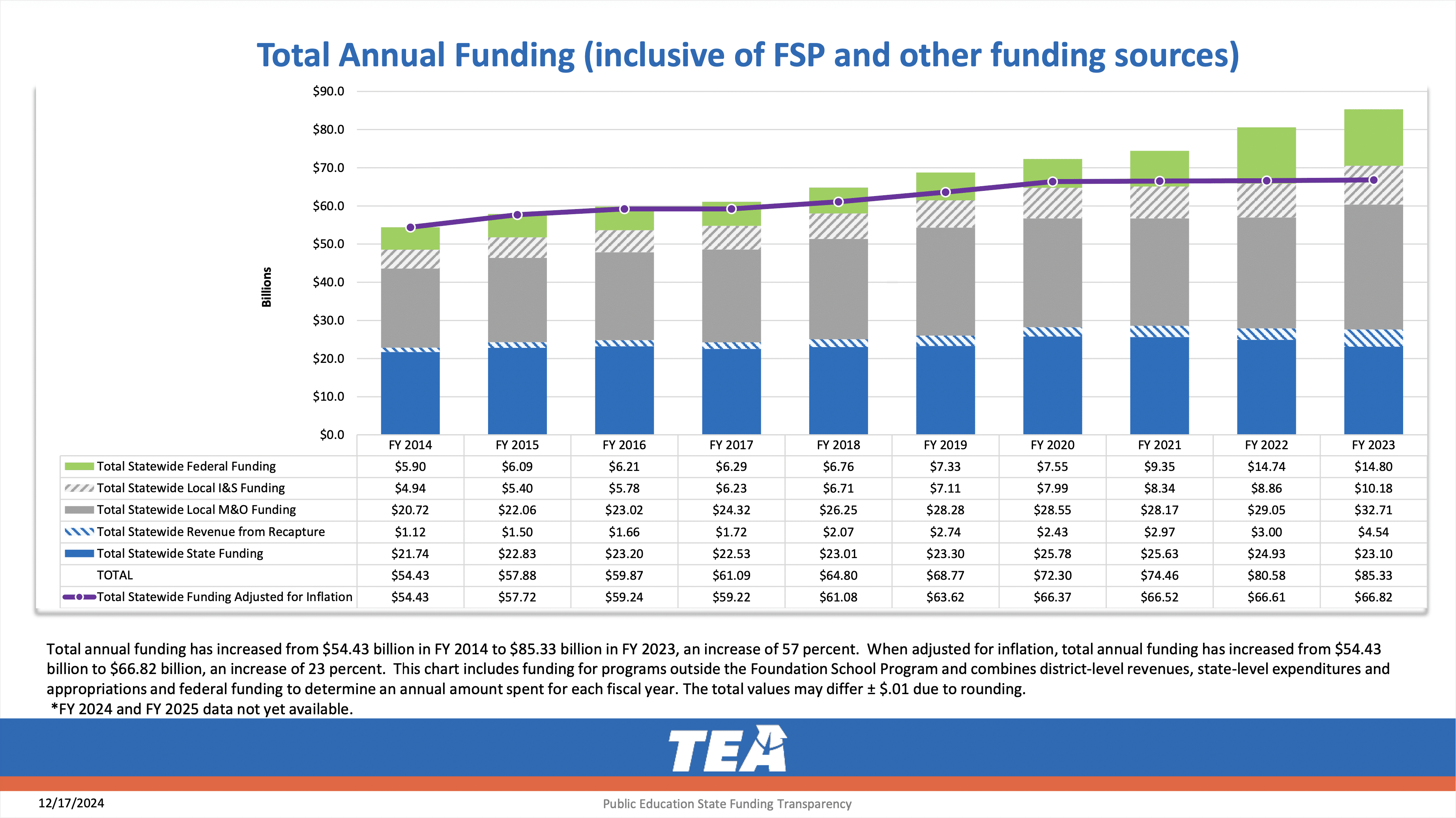

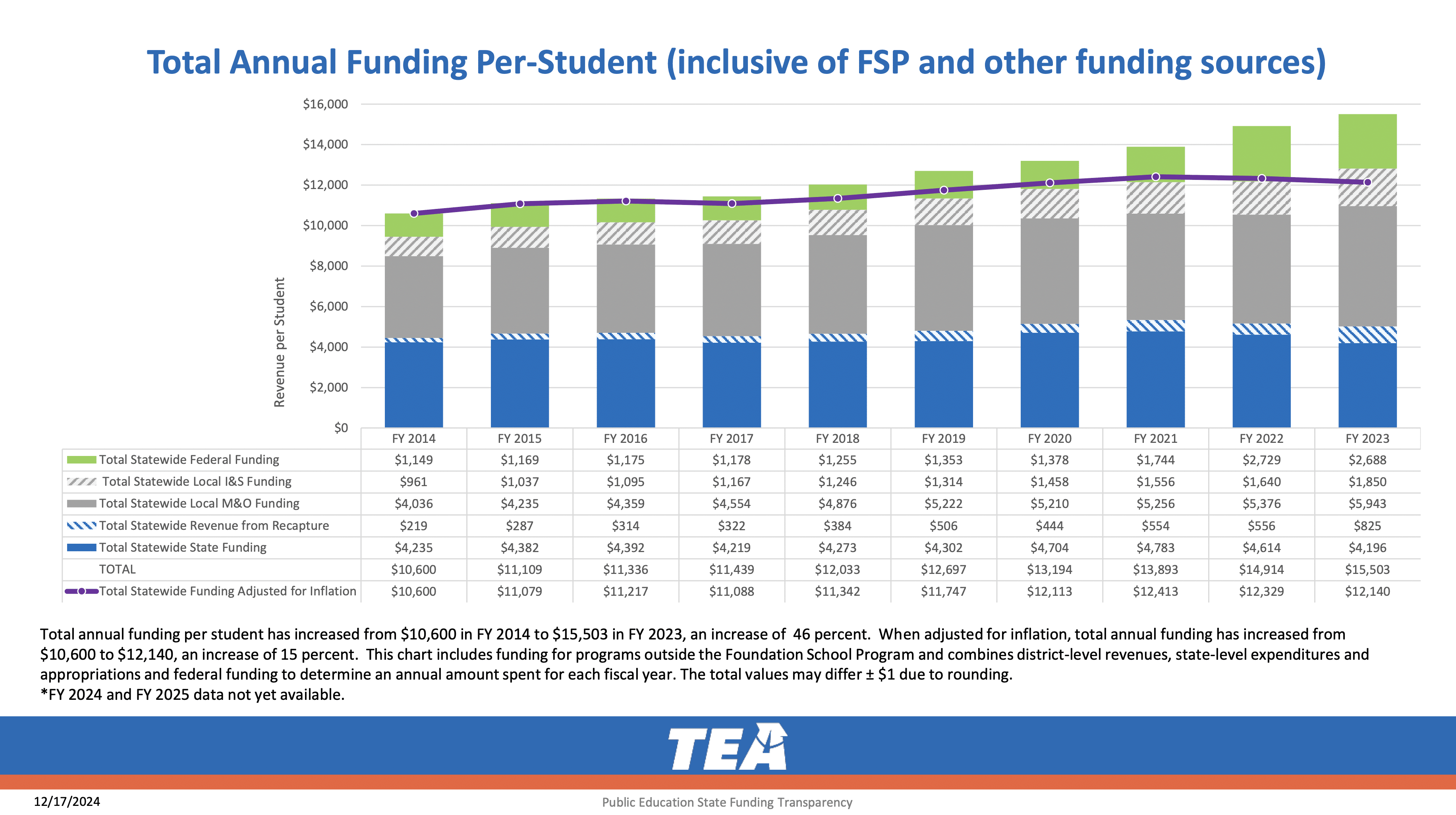

Public school funding in Texas comes from a mix of local, state, and federal sources.

The state constitution says, “It shall be the duty of the Legislature of the State to establish and make suitable provision for the support and maintenance of an efficient system of public free schools.” The state fulfills this responsibility through a system of charter schools and independent school districts.

While charter schools receive funding directly from the state, school districts have their own taxing authority to set a property tax rate within certain limits. These local taxes are the foundation of the school finance system in Texas. The state government then supplements these local revenues from the state general revenue fund, the Permanent School Fund, and other sources, including federal funding for certain programs.

Since 1876, Texas has dedicated millions of acres of public land to support the Permanent School Fund, which pays for textbooks and offsets the operating costs of schools. The General Land Office manages these lands, including oil leases that generate revenue for the fund. The Permanent School Fund is the largest public education endowment in the USA.

Local Property Taxes and Rates

The largest source of school funding in Texas is the Maintenance and Operations (M&O) property tax set by local school districts.

The average tax rate by school districts in most of Texas is about $1 per $100 of taxable value. For a home valued at $300,000, that results in a tax bill of $3,000 before exemptions. The maximum allowable M&O rate for Texas school districts is $1.068 per $100 of property value.

In addition to the M&O tax, taxpayers in some areas also pay an Interest and Sinking (I&S) property tax to repay bond debt issued by districts to pay for major investments, such as new schools. The Permanent School Program guarantees bonds issued by school districts, which reduces their borrowing costs.

State Funding of Texas Schools

The state supplements local property tax revenues with appropriations from the General Revenue Fund, Available School Fund, and State Technology and Instructional Materials Fund.

State education funding comes from a variety of sources, including fuel tax and sales tax. Each year by July 1, the state education commissioner determines a basic allotment of funding to each district, which is based on daily average attendance, not including special education students, for whom the state provides extra funding.

The minimum basic allotment in 2024-2025 was $6,160. Additional adjustments to this allotment can apply. For example, rural school districts that have fewer than 130 students are entitled to a “sparsity adjustment.”

‘Recapture’ or ‘Robin Hood’ System

While the state government doesn’t levy any property tax directly, it does transfer some local revenue from some districts to others. This system, known colloquially as “recapture” or “Robin Hood,” dates to 1993. A school finance reform in 2019 reduced the effects of recapture, but it remains a key part of the school finance system.

The idea behind recapture is that students in different parts of the state should receive roughly equal educational experiences for roughly the same tax effort. But because some districts are property-rich while others are property-poor, even high tax rates in property-poor areas don’t close the gap, resulting in big discrepancies in per-student funding.

‘Recaptured’ funds are paid into the Foundation School Program for redistribution.

Federal Funding of Texas Schools

The federal government provides funding for a variety of special programs in Texas schools, but it doesn’t pay for basic school operations. The largest program is Child Nutrition, which pays for student lunches and breakfasts. Other federal programs support vocational training, English language acquisition, and services for children with disabilities.

These federal programs are administered through a combination of state and local agencies, with oversight from the U.S. Department of Education and other federal entities. In Texas, the Texas Education Agency (TEA) plays a central role in the administration of most federal education programs. The TEA distributes federal funds to school districts and ensures that the funding is used according to federal guidelines and regulations.

For example, the TEA monitors Title I and Title III programs to make sure that funding is being allocated to schools that serve low-income students and English language learners, respectively. The agency also helps districts comply with requirements for special education services under the Individuals with Disabilities Education Act (IDEA), ensuring that students with disabilities receive the appropriate resources and support.

At the local level, school districts are responsible for implementing the programs and reporting back to the TEA and federal authorities. Each district typically has a designated administrator or coordinator for federal programs, who is in charge of managing the funds, overseeing the implementation of services, and ensuring compliance with both state and federal regulations.

For example, a district receiving Title I funding might use the money to hire additional reading specialists, provide professional development for teachers, or run after-school tutoring programs. These local administrators are required to submit detailed reports to the TEA, demonstrating how funds were spent and the impact of those services on student performance. In this way, federal programs are implemented locally but monitored by the state.