A community college district in Texas is a type of special-purpose district that funds and operates a community college or a network of community colleges. Also called junior colleges, community colleges offer course credit transferable to four-year universities as well as vocational training.

In Texas, community college districts are independent units of local government (political subdivisions). This differs from some other states where community colleges are run by county governments or state-administered college systems. Community college districts often span multiple cities or counties, with service boundaries defined by the Texas Legislature and codified in the Education Code.

Enrollment

Community colleges are open-enrollment, meaning admission is not competitive but generally is open to anyone with a high school diploma or GED.

Colleges may still require placement testing for math, reading, or writing to determine whether students need remedial coursework before pursuing college-credit classes.

Many students use community colleges as an affordable entry point before transferring to a four-year institution, while others pursue terminal certificates in trades, health care, or technology. Others enroll part-time while working or raising families, and the average student age at some colleges is higher than at traditional four-year universities. Community colleges also play a central role in dual-credit programs, allowing high school students to earn college credit before graduation.

Approximately half a million students attend a community college in Texas.1

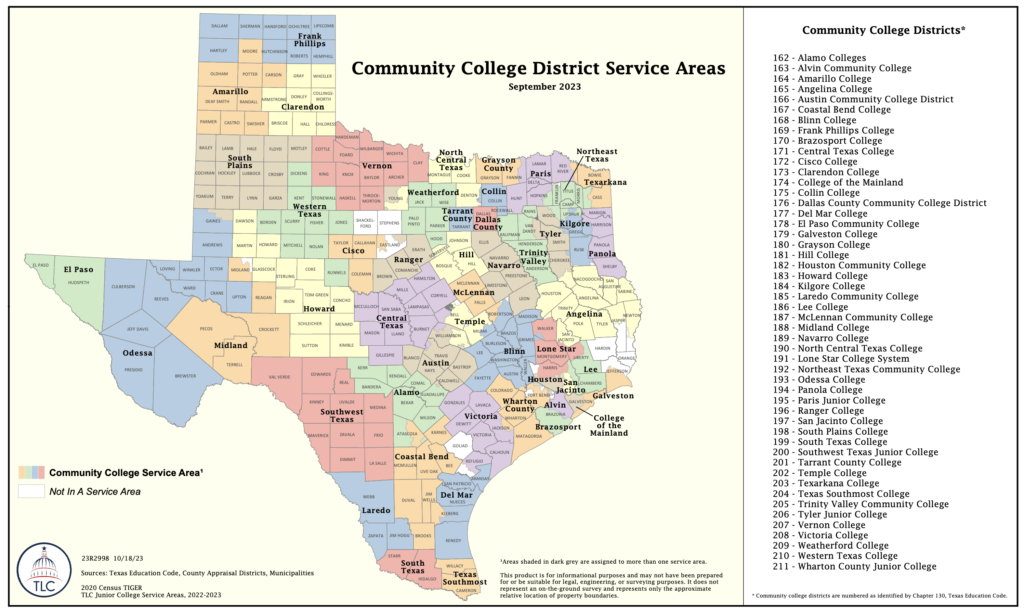

Service Areas

There are about 50 community college districts in Texas, serving most of the state. Some rural regions are not within the boundaries of any community college district but may still be served through contractual arrangements or satellite campuses.

The largest by enrollment are Alamo Colleges District in San Antonio, Austin Community College in the capital region, Houston Community College, Dallas County Community College, and Tarrant County Community College.

Trustee Elections

Community colleges are governed by elected boards of trustees who hire and oversee the president of the college, set policies and an annual budget, and set an annual tax rate.2

Each trustee serves a term of six years. Trustees are not paid.

Elections for this position are nonpartisan, meaning there are no party primaries for the position and ballots do not indicate candidates’ party affiliation. In most districts, trustee positions are elected by geographic subdistricts rather than at-large, though election methods vary across the state.

Taxes and Other Revenue

Community colleges in Texas are funded in three ways:

- local property tax revenue;

- state legislative appropriations; and

- tuition and fees.

Tuition rates are typically lower for in-district residents whose property taxes support the college, while out-of-district or out-of-state students pay higher tuition.

The legislature uses a funding formula based partly on enrollment to determine how much funding to give to each college district. In the 2021-2022 biennium, the 87th legislature appropriated $2.17 billion for Texas community colleges.

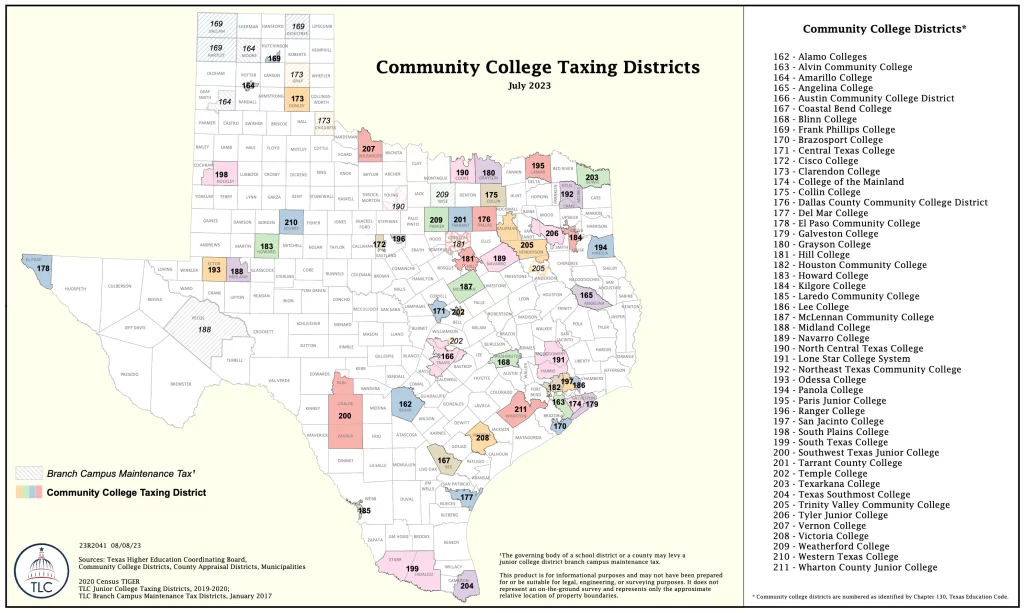

Each district is required by law to set a property tax rate for the maintenance and operation of district facilities (M&O taxes). They may also levy taxes to finance repayment of bonds issued for capital projects, like constructing buildings and purchasing land (I&S taxes).3

Collectively, community college districts raised $2.56 billion in local property tax revenue in fiscal 2023, according to data compiled by the Texas Association of Community Colleges.4

Campus Expansion and Bond Elections

Texas community college districts can issue bonds to finance construction projects, land acquisition, or facility improvements—but only with voter approval. The district’s board of trustees must call a bond election and present voters with a proposition describing the purpose and tax implications of the proposed bonds.5

When a college district seeks to expand its service area, it may do so through annexation. State law allows the board to call an annexation election in a specific geographic area, following notice and a public hearing. If voters in the proposed area approve, the district can extend both its services and taxing authority to that area.6 Annexation elections are sometimes controversial, as residents weigh access to new educational opportunities against the burden of additional property taxes.

Once a branch campus is established through annexation, voters in the newly added area may also approve a separate tax to help fund the campus’s operations. This maintenance tax is capped at five cents per $100 of property value.7 All funds raised through bond elections must be used strictly for capital purposes—not for salaries or daily operating expenses.

Sources and Citations

- Annual enrollment reports, Texas Association of Community Colleges. ↩︎

- Texas Education Code § 130.081–130.090 ↩︎

- Texas Education Code § 130.122 ↩︎

- “FY 2023 Local Revenues Survey Report” (XLSX), Texas Association of Community Colleges ↩︎

- Texas Education Code § 130.122 ↩︎

- Texas Education Code § 130.065 ↩︎

- Texas Education Code § 130.253 ↩︎