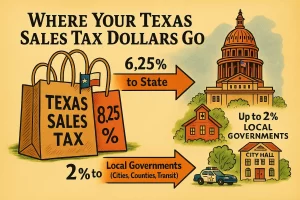

Texas imposes a statewide sales tax of 6.25% on the retail sale, lease, or rental of most goods and some services. This tax applies whether the transaction occurs in person or online, and it forms a major source of revenue for the state government. However, the total sales tax rate a buyer pays depends not just on the state’s base rate but also on local sales taxes added by cities, counties, and special-purpose districts.

Local Tax Add-Ons

Local jurisdictions in Texas can levy an additional sales tax of up to 2%, making the maximum combined rate 8.25%. These local rates vary significantly. Some areas collect the full 2% allowed by law, while others charge a smaller amount or none at all.

The Texas Comptroller of Public Accounts maintains an up-to-date database that details the combined state and local tax rates in each city and county. Businesses are responsible for calculating the correct tax rate based on the location of the transaction and remitting those amounts to the state.

Remote Sellers and the Uniform Rate

To simplify compliance for businesses that sell into Texas but do not have a physical presence in the state, Texas allows remote sellers to collect a 1.75% uniform local tax rate. This optional rate helps streamline the tax collection process for out-of-state vendors, who would otherwise need to calculate varying local tax rates based on the buyer’s location. The total rate for these sellers is therefore 8.0% (6.25% state + 1.75% optional local).

This approach was adopted in response to the 2018 South Dakota v. Wayfair U.S. Supreme Court decision, which allowed states to require out-of-state sellers to collect and remit sales tax.

Sales vs. Use Tax

In Texas, the sales tax is officially referred to as a sales and use tax, because it also applies to certain taxable services and to purchases made out of state for use within Texas. These include:

- Telecommunications and data processing services

- Security services

- Laundry and dry cleaning services

- Amusement and entertainment services

When a taxable item is purchased outside of Texas and brought into the state for use, the use tax may apply at the same rate to ensure the buyer does not avoid taxation by shopping elsewhere.

Motor Vehicle Sales and Rentals

Motor vehicles are subject to a separate but similar tax regime in Texas:

- Sales Tax: A flat 6.25% applies to the purchase price of a vehicle, minus any trade-in allowance.

- Rental Tax: If a motor vehicle is rented, the applicable tax depends on the rental duration:

- Short-term rentals (less than 30 days): taxed at 10% of gross receipts

- Long-term rentals (30 days or more): taxed at 6.25%

These taxes are collected by the dealer or rental agency and remitted to the Texas Comptroller.