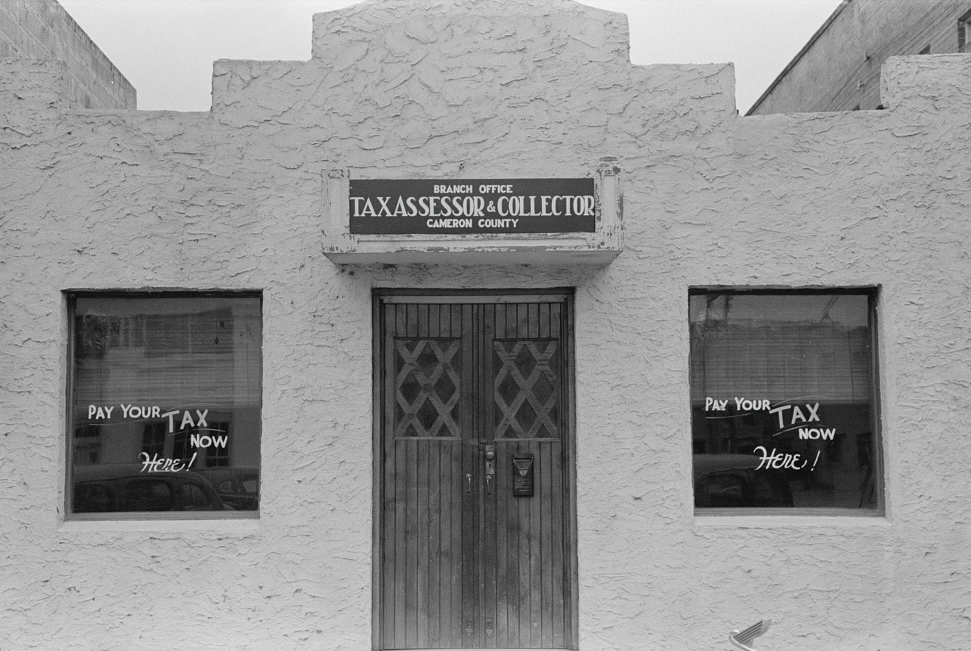

Tax assessor-collectors in Texas are local officials responsible for calculating property tax bills and collecting various taxes and fees on behalf of the state, county, and other taxing entities. Each Texas county has an elected tax assessor-collector, apart from some very small counties where the sheriff’s office may fulfill the duties of tax assessor-collector.

Key Functions

The duties of a tax assessor-collector include:

- Collecting property taxes (but not setting the rate)

- Collecting various other fees for the state and county

- Processing motor vehicle title transfers

- Issuing motor vehicle registration and licenses.

In counties that do not have a designated Elections Administrator, tax assessor-collectors are also responsible for registering voters.

Chapter 6 of the Tax Code lays out the specific responsibilities and powers of county tax-assessor collectors.

Elections

Tax assessor-collectors are elected to four-year terms. Candidates for the position often campaign on issues such as office efficiency, customer service, and transparency. In many counties, the office is nonpartisan in practice, but in larger or more urbanized areas, the role may attract political attention.

Like other county officials in Texas, tax assessor-collectors must file campaign finance reports and can be subject to ethics rules and public scrutiny. Competitive races may center on customer service complaints or policy changes.

Qualifications

A person must meet the following qualifications to become a tax assessor-collector:

- U.S. Citizen

- Resident of Texas for at least 12 consecutive months

- Resident of the county for at least six consecutive months

- Registered to vote in the county

- At least 18 years of age

- No felony conviction

Additionally, while in office, a tax assessor-collector must complete 20 hours of continuing education every year.

Role in Collecting State Taxes

Although tax assessor-collectors serve at the county level, they play a vital role in the broader state revenue system. A significant portion of the money they collect—particularly motor vehicle sales tax, title transfer fees, and registration fees—is remitted to state agencies such as the Texas Department of Motor Vehicles and the Comptroller of Public Accounts.

These collections help fund state highways, public education, and various state-administered programs. The Comptroller’s office monitors local performance and occasionally audits county tax offices to ensure compliance with state law.

Technology and Online Services

In recent years, many county tax offices have adopted online portals and automation tools to improve service delivery. Residents can often renew vehicle registrations, pay property taxes, and update addresses through secure websites. Some offices also offer text or email reminders for upcoming deadlines. These efforts aim to reduce wait times, increase payment compliance, and modernize public access to essential services.