Illuminating Civic Life in Texas

Ad Valorem Tax

![]()

Understanding property taxes in Texas and their role in community services

editorNovember 21, 2022

Tax Assessor-Collectors

![Photo of the door to the Tax Collector-Assessor's Office in Travis County, Texas]()

Elected county officials responsible for collecting taxes

editorNovember 21, 2022

Appraisal Review Boards

![]()

Local mechanism for settling disputes between property owners and Appraisal Districts

editorNovember 21, 2022

Texas Comptroller of Public Accounts

![]()

State agency responsible for budget projections, managing state treasury, and revenues

editorNovember 21, 2022

Education Finance in Texas

![]()

Overview of Texas' school finance system, including state, local and federal sources of revenue

editorNovember 20, 2022

Sales Tax in Texas

![]()

Sales tax rates vary slightly throughout Texas, topping out at 8.25%

editorNovember 20, 2022

Tax Rate Elections in Texas

![Roadside election poster displayed during a tax rate election campaign in Austin, Texas in 2020]()

Ballot measures to raise or maintain local tax rates

editorNovember 20, 2022

Legislative Budget Board

![]()

Agency guides key spending decisions and provides fiscal oversight

editorNovember 19, 2022

Income Tax in Texas

![]()

The Texas Constitution prohibits a state income tax. Texans are still subject to pay federal income tax.

editorNovember 19, 2022

Texas Bond Review Board

![Logo of the Texas Bond Review Board]()

10-member oversight body promoting transparency in state and local debt financing

editorNovember 18, 2022

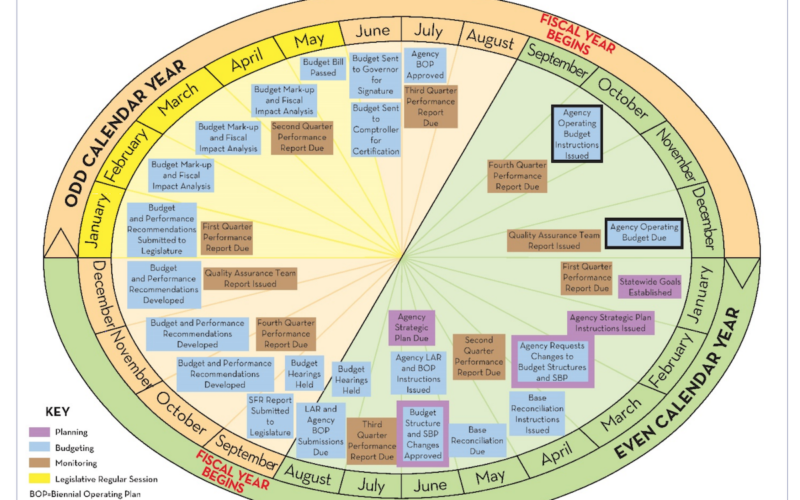

Appropriations Process in Texas

![]()

Understanding the state's two-year budget cycle

editorNovember 17, 2022