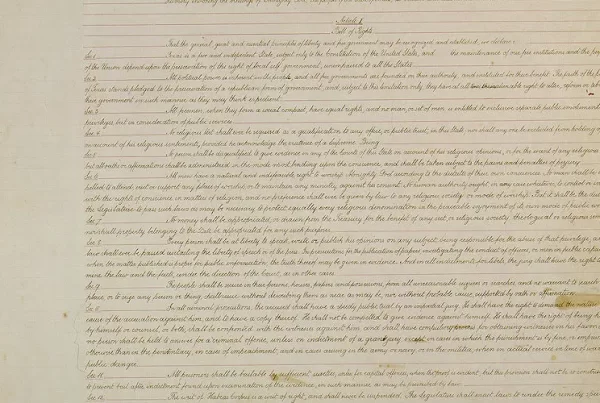

The Texas Constitution imposes a series of formal constraints on state government spending. These limitations are designed to promote fiscal responsibility, ensure balanced budgeting, and prevent the expansion of government expenditures beyond constitutionally or statutorily defined thresholds. Together, they form the core of Texas’s budgetary framework and influence both legislative decision-making and long-term fiscal policy.

Texas operates under a biennial budget cycle, with appropriations determined during regular legislative sessions in odd-numbered years. The state budget must adhere to multiple spending limits enshrined in the Texas Constitution and codified in statute. These limits apply to different categories of spending and are enforced through a combination of legislative oversight, agency certification, and procedural requirements.

Balanced Budget Requirement

Texas law prohibits deficit spending at the state level. Under the “pay-as-you-go” requirement, the Legislature may not appropriate more funds than are anticipated to be available during the biennium.1 The Texas Comptroller of Public Accounts must certify that all appropriations in the General Appropriations Act are supported by projected revenue. If certification cannot be provided, the affected portion of the Act is void unless amended.

Economic Growth-Based Spending Limit

The Legislature may not increase these appropriations faster than the projected rate of growth in the state’s economy,2 as measured by changes in Texas personal income.3 This economic benchmark is set by the Legislative Budget Board prior to each regular legislative session.

The limit does not apply to federal funds, bond proceeds, or dedicated revenue sources such as the Permanent School Fund and Available School Fund.4

The purpose of this provision is to prevent rapid, unsustainable growth in discretionary spending—even during periods of economic expansion—by tying appropriations to a consistent, data-driven measure of statewide economic performance.

Emergency Override Provisions

Although Texas maintains strict constitutional limits on state spending, both major limitations—the pay-as-you-go requirement and the appropriations growth cap based on personal income—include mechanisms for legislative override in emergencies. However, the procedures and political realities associated with each differ significantly.

The pay-as-you-go rule may be overridden only in cases of “emergency and imperative public necessity,” and then only with a four-fifths vote of the total membership in both the House and Senate.5 This is among the highest thresholds found in Texas law and makes such an override extremely rare. The provision functions as a near-absolute ban on deficit appropriations, with very limited flexibility even during times of fiscal stress.

In contrast, the appropriations growth limit may be overridden more easily. A simple majority vote in each chamber is sufficient, provided the Legislature adopts a resolution declaring that an emergency exists.6 Notably, the Constitution does not define “emergency” in this context, giving lawmakers discretion to interpret the term. While procedurally accessible, this override is seldom used. Lawmakers may be reluctant to invoke it out of concern for undermining fiscal restraint or setting a precedent for broader spending increases.

In effect, § 49a establishes a rigid ceiling on total appropriations tied to available revenue, while § 22 imposes a softer cap on spending growth that can be overridden with minimal procedural hurdles but greater political caution. Together, they form a layered system of fiscal discipline—one difficult to bypass and one potentially flexible, but both designed to restrain unsustainable government growth.

Debt Limit

Texas follows a constitutional prohibition against general-purpose debt unless expressly authorized. Article III, Section 49 of the Texas Constitution declares that “no debt shall be created by or on behalf of the State” except in limited circumstances.7 These exceptions include borrowing for specific projects authorized by constitutional amendment and approved by voters, such as infrastructure, education facilities, and water development.

Even when authorized, general obligation bonds backed by general revenue are subject to a constitutional cap. The state may not issue such debt if the resulting debt service (principal and interest payments) would exceed 5% of the average annual unrestricted general revenue for the preceding three years.8 The Texas Bond Review Board is responsible for ensuring compliance with this constitutional limit.

As a result, Texas has no broad authority to issue debt for general operating expenses. The constitutional framework requires that long-term debt be limited in scope, tied to specific voter-approved programs, and structured to minimize fiscal risk.

Welfare Spending Limit

Texas imposes a limit on certain direct assistance payments. The state may not spend more than 1% of the budget on grants to or on behalf of needy individuals, unless the expenditure is approved by a two-thirds vote of each legislative chamber.9 This limit applies primarily to state-funded assistance such as Temporary Assistance for Needy Families (TANF). It does not apply to Medicaid or other programs primarily funded through federal matching dollars.

Limit on Statewide Property Taxation

The Texas Constitution prohibits the imposition of a state property tax.10 While not a spending cap in the narrow sense, this provision limits the state’s ability to raise revenue for general purposes, thereby indirectly constraining expenditures. Local property taxes remain the principal funding mechanism for public schools and other local services, though recent legislation has introduced new voter-approval requirements for increases in local tax rates.11

Rainy Day Fund Spending Constraints

The Economic Stabilization Fund (commonly known as the “Rainy Day Fund”) is governed by a separate set of rules. Transfers from the fund for general revenue purposes require a three-fifths vote in each chamber, while withdrawals for other purposes require a two-thirds vote (Texas Constitution Article III, § 49-g).12 These supermajority thresholds act as indirect constraints on spending by limiting access to accumulated reserves.

Legal and Policy Implications

Constitutional spending limits in Texas reflect a strong preference for fiscal restraint and limited growth of state government. While these provisions are supported by advocates of low taxes and conservative budgeting, critics argue that they may reduce the Legislature’s flexibility to respond to changing public needs or to invest in long-term infrastructure and services. The cumulative effect of these constraints is to reduce volatility in appropriations and reinforce a structural bias toward under-spending rather than over-spending.

Texas remains one of a handful of states with multiple constitutional provisions restricting appropriations, debt issuance, and tax authority. These fiscal constraints have profoundly shaped the state’s approach to budgeting and continue to influence policymaking in both the legislative and executive branches.

Sources Cited

- Texas Constitution Article III, § 49a ↩︎

- Texas Constitution Article VIII, § 22(a) ↩︎

- Texas Government Code § 316.002 ↩︎

- Texas Constitution Article VII, §§ 2 and 5 ↩︎

- Texas Constitution Article III, § 49a(b) ↩︎

- Texas Constitution Article VIII, § 22(b) ↩︎

- Texas Constitution Article III, § 49 ↩︎

- Texas Constitution Article III, § 49(j) ↩︎

- Texas Constitution Article III, § 51-a(b) ↩︎

- Texas Constitution Article VIII, § 24-a ↩︎

- Texas Tax Code § 26.07 ↩︎

- Texas Constitution Article III, § 49-g ↩︎